|

The consumer demand recovery and lasting effects of COVID-19

Courtesy of McKinsey & Company

By Jaana Remes, James Manyika, Sven Smit, Sajal Kohli, Victor Fabius, Sundiatu Dixon-Fyle, and Anton Nakaliuzhnyi

(18).png)

Consumer spending, a major source of economic activity, collapsed as the first wave of the pandemic swept across countries in early 2020. All of a sudden, consumers were forced to change behavior, companies to transform business models, and governments to adjust regulations. And just as the coronavirus has affected regions and individuals in vastly different ways, the economic impact has also been very uneven. Employees able to work from home have maintained jobs and income, accumulating more savings while forced to cut back on spending from lock downs, travel restrictions, and health fears; others lost jobs and income or closed down businesses and have struggled to pay the bills.

While there is reason to be optimistic for a robust recovery in consumer spending once the COVID-19 virus is controlled due to pent-up demand and a significant accumulation of savings, the pandemic, like other crises, will leave lasting marks. Understanding what that means for consumer behavior and the recovery in consumer spending—a critical factor for the global economic recovery—is the focus of this report.

In our analysis, we examine consumer spending in China, France, Germany, the United Kingdom, and the United States. We divide consumers into nine segments based on age and income to determine the size and shape of the consumer demand recovery. Then, drawing on in-depth analysis of six case studies from sectors that cover almost three quarters of consumer spending and encompass a broad spectrum of consumer life, we determine how the mix of consumer demand is likely to evolve and which pandemic-induced behavioral changes are likely to “stick.”

The exceptional nature of the shock provides reasons to be optimistic for the recovery

Unlike previous recessions, this one involves no consumer debt overhang, bursting asset price bubbles, or long-term business cycle fluctuations. The sudden and deep drop in consumer spending across China, the United States, and Western Europe, ranging from 11 to 26 percent in the initial months of the pandemic, resulted mainly from cutbacks to in-person services, especially travel, entertainment, and dining (Exhibit 1).

.jpg)

These categories have been growing over the long term, and consumer surveys indicate a likely strong demand rebound after the pandemic. The massive ten- to 20-percentage-point spike in the savings rate across the United States and Western Europe (amounting to a doubling of annual savings in the United States in 2020) left many households in a strong position to spend (Exhibit 2).

That means an effective vaccine rollout to bring the pandemic to an end could restore consumer demand to pre-pandemic levels, fueled by rising consumer confidence, pent-up demand, and accumulated savings. China’s robust consumer spending recovery after gaining control of the COVID-19 virus is another reason for optimism for most countries.

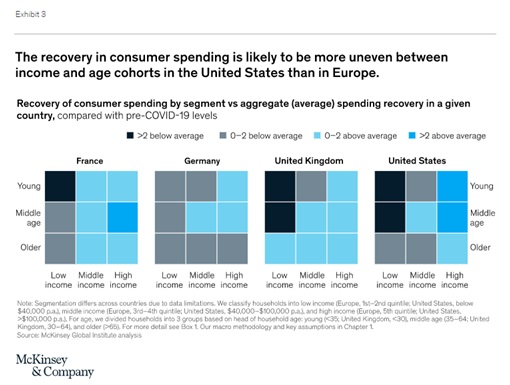

But the recovery is likely to be uneven, especially in the United States

Assuming the pandemic is brought under control, we expect a strong recovery in the United States but an unequal one with variations among income and age segments (Exhibit 3). While many higher income households emerge largely unscathed financially, low income households have lost jobs or face income uncertainty, particularly from changes in the labor market caused by digitization and automation.

As a result, the polarization of consumption between higher and lower income cohorts may increase. We expect spending by mid- and high-income cohorts to bounce back to pre-COVID-19 levels between 2021 and 2022, while spending by low income cohorts could drop below pre-COVID levels once stimulus measures expire. (For more details, see sidebar “Our macro methodology”). Consumption is expected to shift toward older and richer segments, because of both a growing share of the population over 65 and a slower post-pandemic recovery for low-income cohorts. However, we emphasize, this is highly dependent on how quickly health risks recede with vaccinations and whether governments provide further economic support.

We expect a slower but more balanced recovery in Europe, with less pronounced inequality than in the United States. As short-time work programs have helped to protect employment (although with shorter working hours), there is a higher chance for employees to maintain their jobs and avoid a drop in disposable income in 2021. However, there is uncertainty over what might happen to jobs once government support is withdrawn. Still, we expect the stronger safety net (including more stable employment contracts and more expansive labor protection) as well as mechanisms to protect low-income segments to support the recovery of discretionary consumption.

On the other end, high-income consumers did not experience as large an increase in savings as in the United States and the consumption drop was more severe in Europe. As a result, high income households may not accelerate their spending as quickly as in the United States, in line with past recoveries including the one following the great recession. Because of increased economic uncertainty, savings rates are expected to remain slightly elevated after the pandemic, a pattern observed after past downturns.

But there are country variations: Germany, with initially the most effective COVID-19 response (both health and economic) and a strong labor market in both the service and industrial sectors, may recover first, followed by France and the United Kingdom. However, the United Kingdom may have an opportunity to reopen sooner and recover faster, helped by its vaccination campaign, which in early 2021 was the fastest in Europe.

Once the virus is brought under control and reopening is under way, we expect three factors to determine the strength and sustainability of the consumer demand recovery: the willingness to spend by high-income households, income constraints on low-income cohorts, and what happens to savings. What mid- and high-income households do with their accumulated savings (over $1.6 trillion more savings in the United States in 2020 and about $400 billion in Western Europe) after the pandemic—consume, hold, invest, or repay debt—will have an impact on the consumption recovery. The investments made in real estate or other long-term assets do not have a large direct multiplier effect and may take years to add to aggregate consumption.

The pandemic will leave lasting marks on consumer behavior

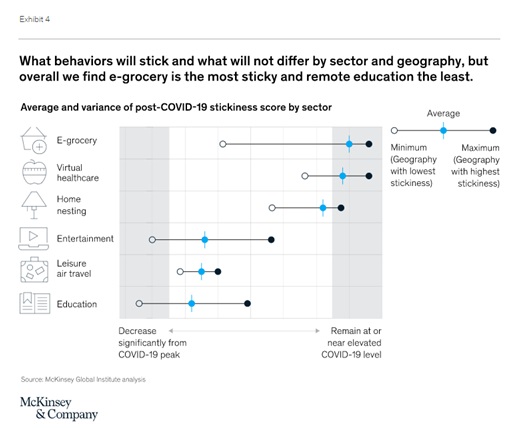

Long-standing consumer habits—more money spent on services, greater digital adoption, and more time and money spent out of the home—have been interrupted, accelerated, or reversed during the pandemic. To determine whether these pandemic-induced behaviors are likely to stick, we examined six consumption shifts that cover a broad range of consumer life and are drawn from sectors that cover almost three quarters of consumer spending.

These include an acceleration of e-grocery shopping, a sharp decline in live entertainment, the emergence of home nesting (that is, spending on items such as home gyms, backyards and gardens, and gaming equipment), a decrease in leisure air travel, a switch to remote learning, and an increase in virtual healthcare visits.

Based on our case study findings, we developed a “stickiness test” that identifies factors that determine whether a behavior will persist (For more details about our methodology, see sidebar “Our stickiness test”). Focusing on the period 2020 to 2024, we determined whether each of our case study behaviors would stick in our sample of major economies.

We found that e-grocery shopping, virtual healthcare visits, and home nesting were likely to stick while remote learning, declining leisure air travel, and decreasing live entertainment would likely revert closer to pre-pandemic patterns (Exhibit 4).

Two consistent patterns stood out across our case studies. First, the COVID-19 pandemic accelerated digital adoption, especially in grocery shopping and healthcare, and this is expected to continue. Second, the pandemic and lockdowns reversed the long-standing trend of declining money and time spent at home, leading to “home nesting.” We expect this behavior to stick as some portion of high-income households will prefer to work from home to some degree after the pandemic and low-income households retain low-cost at-home alternatives such as digital entertainment. At the same time, we expect many other behaviors that the pandemic interrupted—leisure air travel, in-person education, and in-person dining—to resume with the recovery, although potentially with modifications from the experience of the pandemic.

We found that an important precondition for stickiness is adequate infrastructure, typically defined as basic physical and organizational structures and facilities, such as buildings, roads, and power supplies, needed for the operation of an enterprise or society. How adequate infrastructure is can affect consumer, industry, and government response in determining the stickiness of behaviors.

· In the case of consumers, reliable internet access played a role in determining whether consumers had a good or bad experience with remote learning and ultimately whether they are willing to try it again.

· In the case of industry, it could apply to supply chains and the network of third party relationships. For example, in e-grocery, those companies with established delivery capabilities and relationships were able to respond to the new environment quickly and effectively, determining the choices consumers had.

· In the case of government, infrastructure policy can enable and support consumption. For example, comprehensive digital infrastructure is key for access to virtual healthcare.

There are other behavioral changes that we did not cover in our case studies: sustainability is one; an increased focus on health is another. (See sidebar “Sustainability” for more on this topic.) We think tracking the stickiness factors—consumer behavior as well as company offerings and government role—could help predict the nature of long-term behavioral changes we should expect. On both accounts, however, the likelihood of consumers actually supporting these choices will critically depend on the product choices and pricing that companies offer, as well as the regulatory incentives for both companies and individuals to shift toward more sustainable or healthy goods, services, and behaviors.

To read the full report, please visit https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/the-consumer-demand-recovery-and-lasting-effects-of-covid-19

About the author(s)

Jaana Remes is a partner of the McKinsey Global Institute, where James Manyika and Sven Smit are co-chairs and directors. Sajal Kohli is a senior partner in McKinsey’s Chicago office. Victor Fabius is a partner in the Paris office. Sundiatu Dixon-Fyle is a visiting senior fellow at the McKinsey Global Institute based in London. Anton Nakaliuzhnyi is a consultant in the Los Angeles office.

This report was edited by Anna Bernasek, a senior editor at the McKinsey Global Institute.

|