Never ending Disruption: How Should the Company React?

Never ending Disruption: How Should the Company React?

Uncertainty is inevitable in any business nowadays and the magnitude of its severity is ever increasing. Business giants that used to be market leaders may be driven out of business by new comers with more advanced technologies. But not for long, the new winner, too, could go bust when another competitor with more superior technologies enters the market. This example is just one example of business circles that is increasingly present today and is thought to have more to come in the future. This kind of incident is part of a condition we called “Disruption” that many people tend to define as “a state of interruption”. Disruption, however, is more like the “sea that never sleeps” because after one wave causes organizational or business change, there will still be new waves that are always ready to come in.

Disruption can occur in various forms such as substitute goods or services presented in new formats. For examples, online movie streaming service provider “Netflix” defeated “Blockbuster”, one of leading U.S. video rental giants, while traditional banking business was disrupted by new financial transaction format known as Cryptocurrency. Disruption can also come in the form of substitution by irrelevant goods and services. For example, shopping malls were replaced by cafés, restaurants, or sport communities that offer leisure alternatives. Another form of disruption that can generate widespread impact is disruption caused by external factors, which can hardly be controllable or difficult to control. For examples, protests by stakeholders that eventually lead to business interruption, natural disaster like tsunami, and pandemic like COVID-19 that cause sudden impacts on business in large scale.

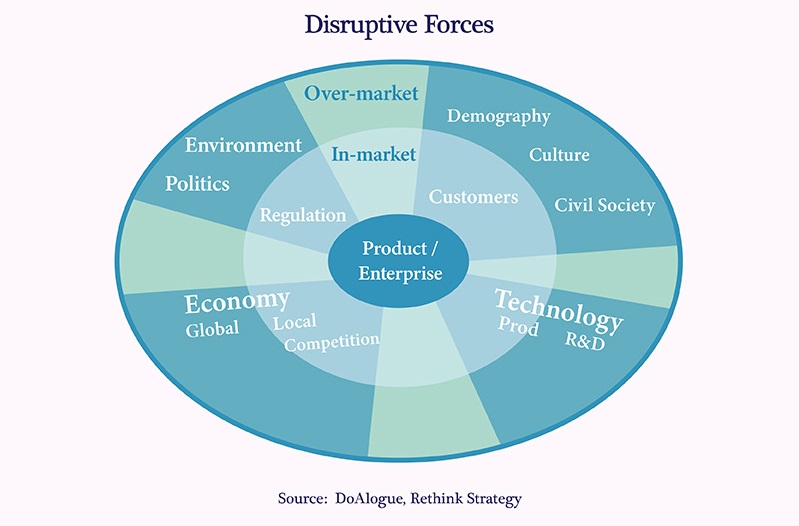

Regardless of disruption forms, the first thing any organization need to do to stay viable is to identify factors that could cause such disruption. This is a collaborative role between the Board and management to jointly discuss and identify key factors that could influence corporate performance. They can be either predictable in-market factors or over-market factors that are difficult to anticipate. (Figure 1)

The key problem in identifying disruptive factors is not the difficulty in finding such factors or reaching an agreement among the Board and management. Instead, the Board and management never recognize the significance in the discussion on this matter because they fell into the “success trap”. In such case, they emphasize on seeking benefits from current business activities (past success) and ignoring the necessity in seeking new opportunities or considering the long-term sustainability of the organization. Therefore, if the corporate leaders cannot avoid or escape the success trap, the organization is prone to be disrupted easily.

However, under the current circumstances, corporate leaders cannot deny the need to discuss the disruption situation. The next crucial challenge is how the organization will manage and respond to the disruptions that may affect the company. Since no one can predict when the next wave of change will arrive, each organization needs to place their bets. Many organizations brand this step as strategic decision-making though it is basically betting on unknown factors.

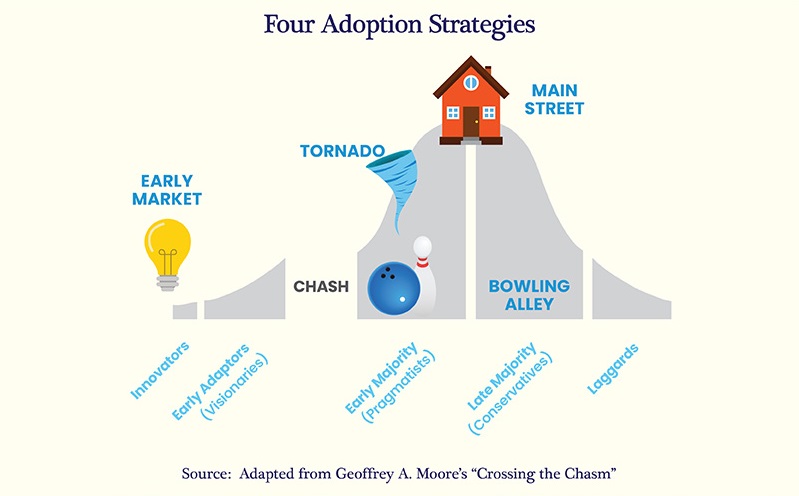

From the book “Crossing the Chasm” by Geoffrey Moore, it provides a broad framework of four adoption strategies to the disruption. (Figure 2)

1: Visionary

This strategy is to adopt ahead of the herd. It means the organization chooses to make proactive move rather than being forced to make adjustment. This will distinguish the organization from the rest, create advantage gap against competitors, and secure new set of customers. The strategy contains high risk but can also yield high return. Organization adopting this strategy often responds to disruptive factors by initiating new product or business model, which is considered high-stake investment. A fine example is Tesla that came up with electric vehicle innovation after it found that electricity will disrupt fuel vehicles in the future.

However, this strategy is usually adopted by start-ups, backed by investors, because a success will yield substantial return while a failure will not incur much loss for them. Therefore, we do not see many market leaders or those with competitive advantage adopting this strategy because it can create adverse effect on their core businesses.

2: Pragmatist in Pain

This strategy is for early adoption, not for competitive advantage but to counter offence by disruptor. It is meant to preserve the company’s status in the market, not to acquire new set of customers. Examples of this strategy are cable TV operators that offer streaming alternatives to preserve clients from switching to Netflix. So long as the service covers, clients do not want to face difficulties in changing to other providers. Another explicit example is Samsung, android-based smartphone producer that attempts to chase or develop features/functions of its handset to catch up with Apple’s iPhone.

If an organization chooses this strategy, it should emphasize on tracking strategies of key rivals that started to disrupt to stay in business and grow along with the competitors. However, the key risk for organization adopting this strategy is the copyright violation which could easily occur and result in huge fines to the company.

3: Pragmatists with Options

This strategy is adopting with the herd, not to pursuit competitive advantage but to gain explicit benefits and enhance efficiency. Organizations using this strategy usually look up to those already use the method and prove its worthiness. If new technology is involved, it must have been proven that it creates benefits and the organization will then adjust to stay afloat in the disruption trend.

The method has low risk and medium reward. Examples are numerous restaurants that adopted more social and online delivery channels as the efficiency/operating functions of online platform have been proven to be successful in accommodating restaurant business for a certain period of time. However, if a number of players adopt this strategy at once, the organization may need to create additional strengths to retain its status in the market.

4: Conservative

This strategy is to postpone the change as long as possible. It matches organizations that do not need to adjust or those in businesses with limited disruption risks. The organizations may be monopoly or restricted by laws and not in competitive market such as state-owned enterprises. Therefore, an adjustment to disruption only occurs when necessary to reduce operating cost or enhance efficiency. However, factors protecting business such as legislations or restrictions could be cancelled, therefore the organizations need to be careful as they may face competitors or other substitutes.

Of the four strategies, the organization should choose only one that match its operations. Adopting many strategies at the same time could create confusion and unclear strategic paths.

All organizations must adjust to disruption. No organization can escape disruption, the difference is just a matter of time and magnitude. More importantly, every organization must always be aware that disruption situations never cease to occur, just like the waves in the sea. Therefore, they need to be alert and persistently monitor situations and surrounding context. The Board and management must particularly be the leader in this front to ensure the viability and sustainable growth of the organization.

Tanakorn Pornratananukul

Assistant Vice President

Thai Institute of Directors (IOD)

|