Significance of CG Committee nowadays

The world has experienced a number of economic and financial crises throughout history, many of which had adverse effect on Thailand. The reputable “Tom Yum Kung” crisis, actually originated from Thailand, derived from overinvestment by the private sector and lax lending practices of financial institutions. After the economic bubble popped, numerous finance companies and banks went busted and entered rehabilitation. Such incidents had substantial and lasting impact on operations of listed companies to the present day.

The Asian financial crisis made Thailand and the rest of the world take corporate governance more seriously, both for regulators and the private sector. Although all parties have emphasized more on CG but another significant national issue concerning governance is corruption.

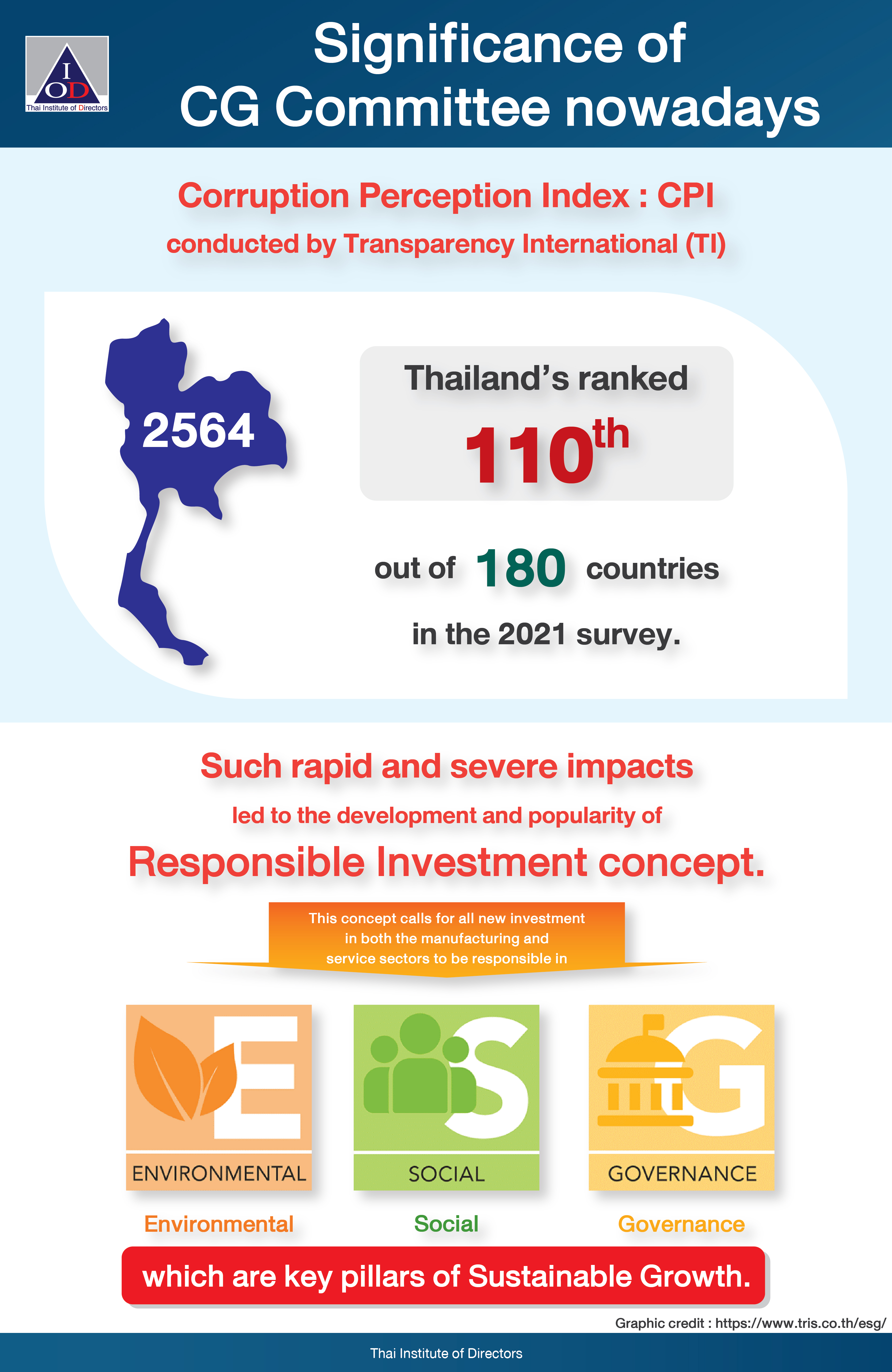

According to Corruption Perception Index (CPI) conducted by Transparency International (TI), Thailand’s score fell to 35 out of 100 and ranked 110th out of 180 countries in the 2021 survey. The weak outcome made it a national agenda to improve governance transparency, both in the public and private sectors.

Corporate Governance Committee (CG Committee) has been an essential element of listed companies for over 20 years. It was established to support operations and provide guidance in the formation of Corporate Governance Policy and Guidelines as well as Code of Conduct to comply with laws, regulations, and relevant criteria. The CG Committee also oversees anti-corruption and compliance practices to drive transparency and accountability of companies in the Thai capital market and upgrade CG and anti-corruption standards in the national scale.

Over the past 5-10 years, global economic and industrial growth generated inevitable social and environmental impacts. Such rapid and severe impacts led to the development and popularity of responsible investment concept. This concept calls for all new investment in both the manufacturing and service sectors to be responsible in environment, social, and governance aspects, which are key pillars of sustainable growth.

In 2022, ESG has become issues seriously embraced by listed companies and global investors. The three aspects have been employed to gauge company’s ability to generate long-term gain beyond financial figures. Applying ESG principles with business direction could create positive reputation and image of company and at the same time accommodate sustainable growth. Therefore, companies should integrate ESG aspects into normal operations instead of conducting separate social and environmental activities or projects. Many companies have assigned CG Committee to oversee and monitor corporate governance and ESG issues then report back to the Board. Such practices indicated that Boards paid serious attention to ESG improvement, which can bolster the corporate image.

For many companies, ESG development is rather new and sometime they cannot see direct linkage between reputation, financial gain, and short-term risks though they will have inevitably long-term effect. It has become a major trend for global community to take parts in mitigating ESG impacts. All companies should therefore establish CG Committee, an essential element of the Board that will accommodate concrete progress toward sustainable growth.

Besides inclusion of CG Committee into the Board’s structure, there should also be a process to help CG Committee develops knowledge and understanding of CG structure and/or direction as well as internal procedures to integrate ESG aspects in alignment with the company’s business activities.

Jutamath Permpoon

Analyst – Researh and Development

Thai Institute of Directors Association (IOD)

|