Direction of Corporate Governance after COVID-19

You've probably heard the saying “After the outbreak of COVID-19, our world will never return to the way it was.” Well, the saying isn’t so exaggerated as we are stepping into a state of "Next Normal" where consumer behavior opens to new technologies and digital services with more concerning on health security and environmental impact. As well as business sectors operations are requiring a lot of business adjustment. Organizations need to cope with the competition in post COVID-19 world as well as business adjustment to meet the changes over the past years. This brings up the issue whether the current Corporate Governance Practice Framework is still suitable and working well in a changing social context?

The Organization for Economic Co-operation and Development (OECD) is an organization that has established "The Principles of Corporate Governance" since 1999 which was accepted and applied to evaluate the corporate governance assessments internationally and gained recognition as a benchmark for governments and regulators globally. The Principles were first reviewed by the OECD in 2015, then after the COVID-19 situation has been improved in 2022, the OECD Corporate Governance Committee together with related regulators and ministries more than 50 countries therefore revisited and strengthened again the G20/OECD Principles of Corporate Governance. The complete version was expected to be published in the 3rd quarter of 2023.

The 10 key issues reviewed in the G20/OECD:

• Corporate ownership trends and increased concentration

• The management of environmental, social and governance (ESG) risks

• The role of institutional investors and stewardship

• The growth of new digital technologies and emerging opportunities and risks

• Crisis and risk management

• Excessive risk taking in the non-financial corporate sector

• The role and rights of debtholders in corporate governance

• Executive remuneration

• The role of board committees

• Diversity on boards and in senior management

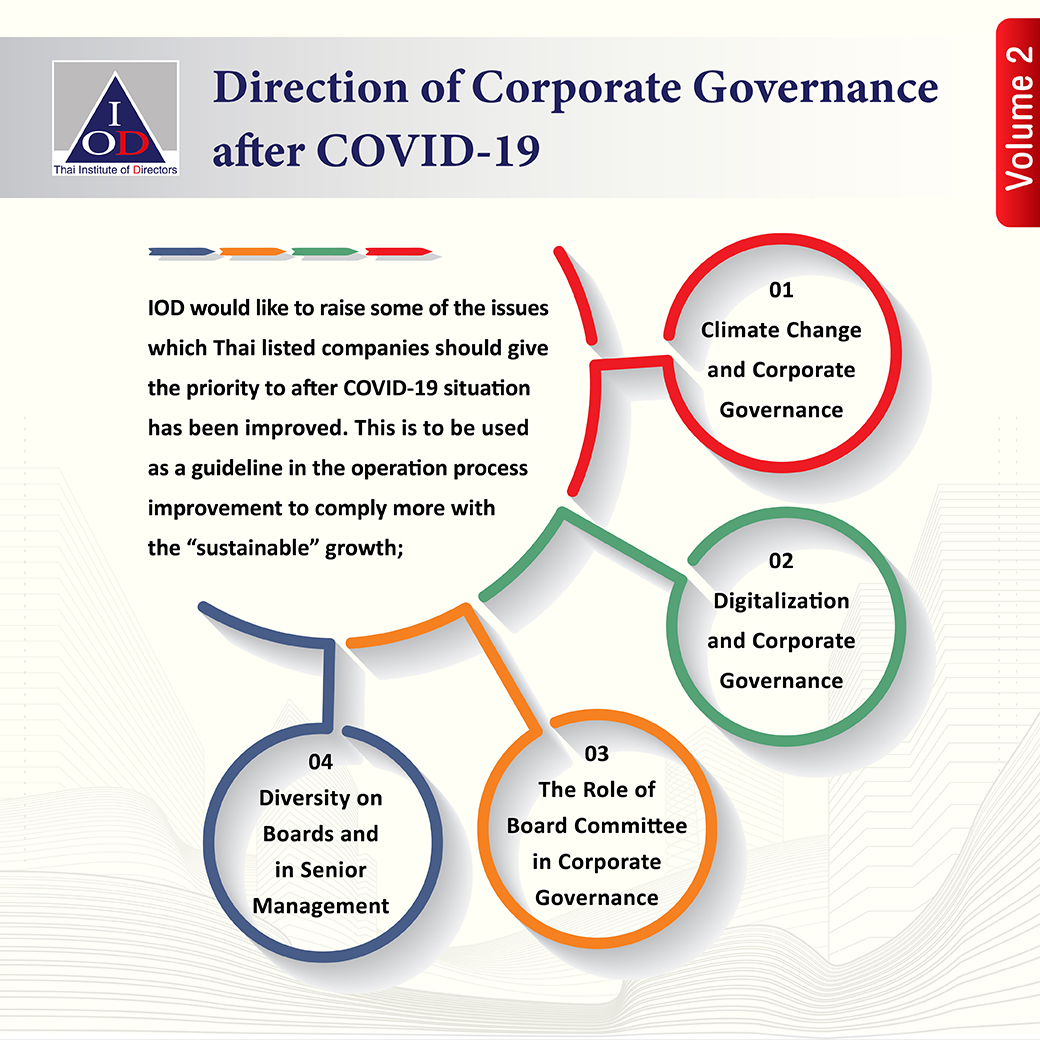

IOD would like to raise some of the above issues which Thai listed companies should give the priority to after COVID-19 situation has been improved. This is to be used as a guideline in the operation process improvement to comply more with the “sustainable” growth;

1. Climate Change and corporate governance

The outbreak has more fostered a trend of environment, social and governance (ESG) responsibility. According to an OECD survey, investors are increasingly concerned in climate and ESG risks as part of their investment decisions. Shareholders have more opinions on environmental and ESG issues, for example, company's greenhouse gas reduction goals or selecting a company director who can drive the organization to achieve its strategy on reducing carbon dioxide emissions. This including complaints or litigation the company that inappropriate approaches to environmental risk management, etc. Therefore, every organization should put the ESG risk management as their priority.

In addition to reducing the company's own greenhouse gas emissions, the companies should encourage their partners to operate the business in reducing carbon dioxide emissions or consider purchasing products and services that are friendly to environmental (Green Procurement) into the company's procurement process which will also elevate the ESG corporate governance as well.

2. Digitalization and corporate governance

COVID-19 situation is a catalyst to change organizations operational processes to digitalization. Including learning process, acceptance, and to be familiar with technology within a short time. The first thing to be seen was employees remote working model, Board Meetings and AGM which has been adjusted to an online or virtual platform. This is expected that the technology of video conferencing will become a new normal for meetings as it's convenient and able to accommodate a large number of attendees.

The technological advancement is a challenge that comes with great business opportunities. However, these changes must be clearly communicated to all stakeholders as well as updated regulations related with the regulators to prevent the problem that might occur later.

3. The role of board committee in corporate governance

Nowadays, the company’s Board of Directors have more considered appointing sub-committees in specialties. The purpose is to assist in companies’ operations under Covid-19 situation and to support Board of Directors to perform more effectively, for example, Risk Management Committee, Corporate Governance Committee, Sustainability Committee or Information and Digital Technology Governance Committee etc. As these sub-committees have in-depth in specific knowledge and expertise and it is a clear assignment for the jobs and responsibilities. However, the necessary of appointing sub-committees is considered to Board of Directors discretion and business necessity as they might occur working in silos or an unnecessary expense.

4. Diversity on boards and in senior management

Effective board of directors’ structure should consist of diversity of directors, such as diversity in professional skills, specialization, gender, age, culture, ethnicity and work experience etc. The Good Corporate Governance Practices in some European and Asian countries have clearly prescribed the quota of women directors in their boards. This is to encourage and increase the opportunity for women to have more role as a director in organizational management. According to Security Exchange of Thailand (SET) Good Governance Research which at the end of 2020, which 87.3% of all listed companies have appointed at least one women to be a director of their board members. This portion has been continuously increasing since 2015 which was 79.4% plus the Security Exchange and Commission, Thailand (SEC) has been driving this directive by setting as a goal in 2020 to encourage 30% of Thai listed companies to have at least 30% of women directors in their board of directors. This is expecting to increase the proportion of female directors in board of directors in the future.

Working in post COVID-19 world has more limitations and against the clock. Some organizational cultures may have changed, therefore, companies should support, accept and value equality and diversity and use as criteria for their board nomination process as well.

In conclusion, Good Corporate Governance is still the key factor for organization transformation to thrive through the "Next Normal " and "Sustainable" growth. The OECD values that organizations with Good Corporate Governance are more able to be listed in the capital market, has stabilize financial performance and has potential to create new innovation that supports green business and digital transformation in long term. Please visit for more information on the review of the G20/OECD Principles at Review of the G20/OECD Principles of Corporate Governance.

Aurakarn Jungthirapanich

Assistant Manager – R&D Management & Advocacy

Thai Institute of Directors

|