Directors Compensation Survey Summary 2022

Thai Institute of Directors Association (Thai IOD) has conducted the Directors Compensation Survey 2022 of listed company in Stock Exchange of Thailand (SET) and Market for Alternative Investment (MAI) with the total of 309 listed companies participated which was 40% of the total number of listed companies in the stock markets. The survey can be summarized as follows:

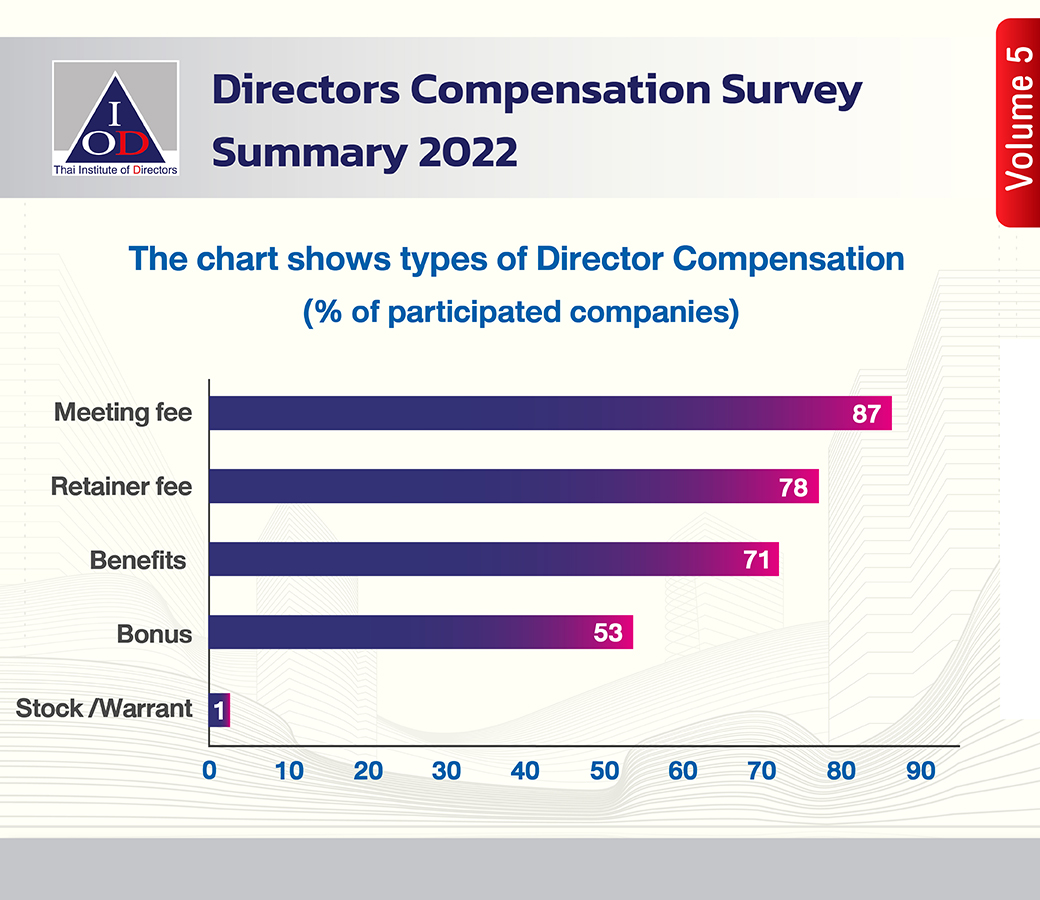

1. Most companies offered the director compensation in cash-based compensation which were meeting fee (87%), retainer fee (78%) and bonus (53%). The most director compensation forms offered were retainer fee, meeting fee and bonus in combination which was 36% while the form of non-cash compensation were stock and warrant were offered in only one form of each company. However, in term of benefit (71%), directors will receive the benefit in many forms such as company car, accident insurance, life insurance and medical allowance.

2. The average annual compensation of a Chairman (retainer fee, meeting fee and bonus) was THB1,216,250 which was 55% higher than an Executive Director and 57% higher than a Non-Executive Director.

3. The median retainer fee of a Chairman was THB45,000 per month which was 1.67 times higher than an Executive Director and 1.8 times higher than a Non-Executive Director.

4. The median meeting fee of a Chairman was THB29,375 per meeting which was 1.46 times higher than an Executive Director and a Non-Executive Director.

5. The median annual bonus of a Chairman was THB500,000 while the median annual bonus of a Non-Executive Director was THB354,273 and an Executive Director was THB340,254 respectively.

6. Members of Sub-committees were offered only in the form of cash-based compensation which were retainer fee, meeting fee and bonus. The compensation were mostly in the form of meeting fee which the Chairman of Sub-committee usually received higher compensation than other committee members.

Moreover, the survey has considered changes in director compensation in 2022 compared to 2021 and found that most companies offered retainer fee and meeting fee at the same rate which was 81% while 19% had an increase and decrease their director compensation rate.

The companies with increased compensation mostly considered to directors roles and responsibilities which were increased accordingly and compared the compensation to the similar industry and market capitalization. The companies with decreased compensation mostly adjusted to be comparable to the similar industry.

According to the Director Compensation Survey Summary 2022 shows that most companies offered the director compensation in cash-based compensation which are retainer fee, meeting fee and bonus as well as offered other benefits to the directors. However, the compensation in the form of stock and warrant are not popular in Thai listed companies yet. The board should consider from the overview of director compensation best practice of Thai listed companies and adjust to apply appropriately according to each company context.

However, the board should conduct the remuneration process with transparency and disclose the policy and criteria to determine the remuneration for the directors which reflect duties and responsibilities of the directors including the forms and amount of the remuneration to propose to the shareholders to approve in every AGM both cash-based compensation and non-cash compensation. The level and composition of the director compensation should be appropriate and sufficient to motivate and maintain qualified directors and should avoid the excessively payment.

Siriporn Wongkeaw

Senior Analyst - R&D Management & Advocacy

Thai Institute of Directors Association (Thai IOD)

|